Can U Get Car Insurance With No License

At first thought, the idea of purchasing car insurance without a license might seem a little odd. If you can't drive, why would you need to insure your vehicle? It turns out that there are many scenarios in which having auto insurance is a smart idea and could even save you money!

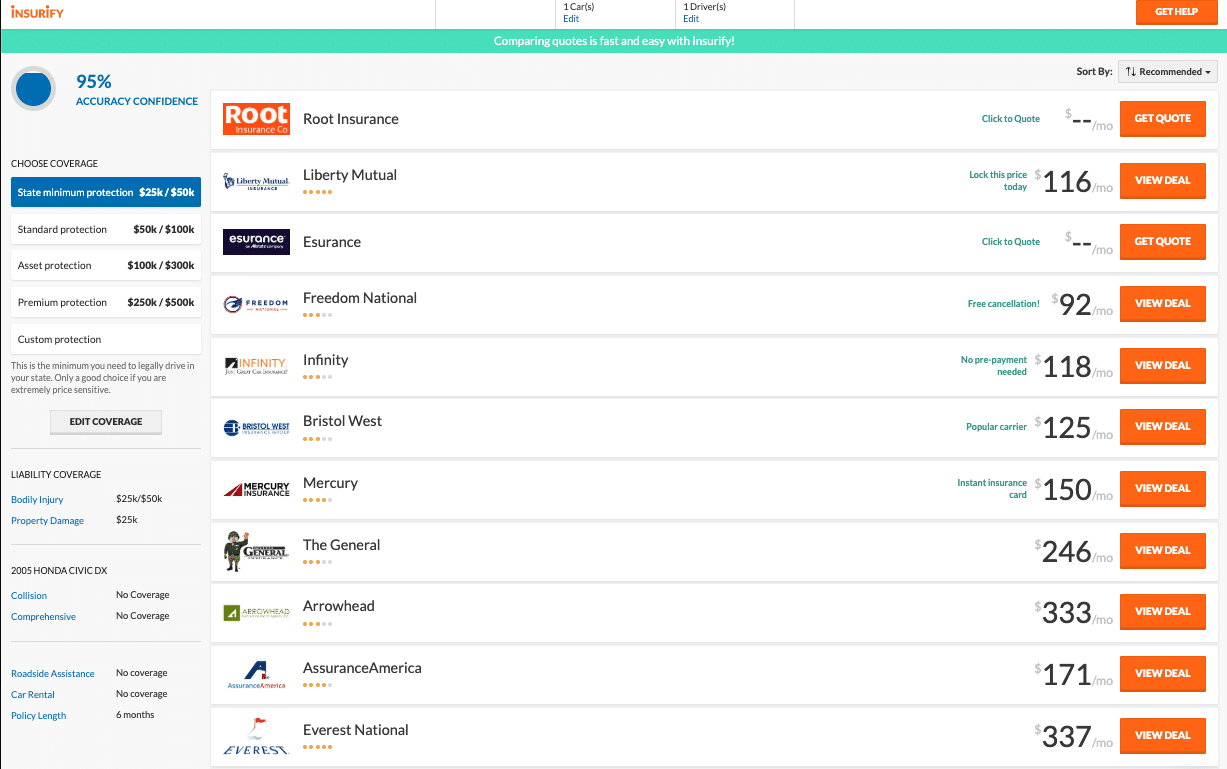

If you're on the hunt for insurance coverage yet you don't have a valid driver's license or your driving record is less than stellar, you'll certainly want to do some research to find the best price available. Rather than visiting multiple websites to obtain individual quotes, try using Insurify . You'll be able to compare prices quickly and easily and before you know it, you'll be purchasing your auto insurance policy !

Score savings on car insurance with Insurify

Can you get car insurance without a license ?

Many people assume that you have to possess a driver's license in order to purchase auto insurance , but that's simply not the case. There are a number of situations where an unlicensed driver will want to have auto coverage, not only to protect their vehicle and themselves but even to save money on their monthly premiums.

So who exactly might need to obtain car insurance when they don't have a license? Insurance companies often work with individuals in the following situations:

- Teen drivers who have a permit and are learning to drive need to make sure they are covered . If a family member cannot put them on an already existing policy, it might be necessary to get an individual policy.

- Auto insurance coverage can be very expensive for licensed drivers under the age of 18 . Even if you don't have a license but you have a young family member who does, it might be much cheaper to be included on his or her policy. Having a "responsible" adult on the policy, as opposed to just one minor, could signal to insurance providers that the policy is in good hands.

- Remember, car insurance isn't only for instances when you're on the road . Collectible car owners may want to invest in an auto insurance policy to cover acts of vandalism or theft.

- Perhaps your driving privileges have been revoked due to health issues or you're in a financial position that affords you a personal driver —in either instance, you'll still need auto coverage even if you don't have a license anymore.

Remember, every situation will be a bit different, so it's best to speak with an insurance agent to determine whether you'll need a policy even if you don't have a valid license .

How to get car insurance with no license

When you're ready to buy car insurance , don't let not having a license get in your way. In many states, the process is still much the same, and while some companies might ask for your driver's license number to give you a quote, others will only ask how many years the primary driver has had a license.

Rather than spending your time visiting website after website getting auto insurance quotes , head over to Insurify, an auto insurance quote comparison . You won't be asked for your license number and can easily compare personalized quotes from a variety of insurance carriers in minutes.

Once you've found a policy that meets your specific needs, make sure to follow up with an insurance agent when you enroll. You might be asked for the license number of the primary driver , so have that information handy.

Who's allowed to be a primary driver on a car insurance policy ?

All car insurance companies require that a primary driver be listed on an auto insurance policy , but if you don't have a license, who can you name? In general, a primary driver is considered to be the person who uses the covered vehicle the most.

However, it's important to consider that most insurance carriers will base your rate on the driving history of the primary policyholder . Does this person have a DWI or a high-risk driving record ? If you have the ability to name one of several different people as your primary driver , consider your options carefully.

How do I add a named or primary driver on my policy?

Insurance providers offer several ways for you to designate who and who is not covered on your auto policy. As we've mentioned above, you must have a primary driver listed. You also have the option to include one or more named drivers as well. These individuals either have a provisional license or a DMV issued driver's license and while they do operate your vehicle, they don't drive it as often as the primary driver.

Your insurance provider also allows you to exclude specific drivers from your policy. Instead of simply not letting them use your car, you can actually save money on your policy if you exclude them. Anyone in your household who has a license suspension or a high-risk driving history could potentially cause your rates to skyrocket, so by excluding them, you're promising your insurance carrier that this person won't be operating your vehicle.

Cheapest car insurance with no license

Trying to find the best deal on an auto policy with no driver's license can be a bit tricky. While more well-known companies like Allstate or GEICO might be able to provide coverage, it could come at a cost.

If you're on the hunt for cheap auto insurance , try using Insurify instead. You can enter in the specific coverage options you're looking for and compare quotes from multiple companies in a matter of minutes!

Score savings on car insurance with Insurify

How to get car insurance with a suspended license

If you have a suspended license , a DWI on your record, or a history of high-risk driving behavior, the DMV might require that you enroll in SR-22 insurance coverage . These policies can often be significantly higher cost than more traditional car insurance , so it's best to thoroughly explore your options before you make a purchase.

Insurify lets you compare pricing for SR-22 policies with ease, so rather than spending days on end looking for the best deal, you can receive customized quotes with just a few clicks of your mouse.

FAQ: Car Insurance with No License

If I get in a car accident but don't have my license on me, will this impact my insurance rates?

Most states legally require you to have your license on you while operating a motor vehicle. However, your insurance rates are ultimately determined by a number of factors, so you'll want to speak with an insurance agent to better understand how your policy is affected.

How do I get car insurance without a driver's license?

If you own a car but don't have a driver's license, you can still obtain coverage fairly easily. Head over to Insurify to compare prices and determine which policy will best meet your needs.

How can I compare cheap car insurance quotes online?

The best place to compare auto policies online is through Insurify. Simply answer a few simple questions and you'll be able to see which policies are the cheapest.

Conclusion: Finding the best and cheapest car insurance quotes online

Obtaining car insurance without a license doesn't have to be a frustrating task.

Now that you have an understanding of your options, it's time to visit Insurify, an insurance comparison site, to see all the options available to you in your area. Compare prices, review policy options, and find the best car coverage for your needs today!

Score savings on car insurance with Insurify

Updated July 23, 2021

A former licensed insurance producer, Courtney Levin has been a freelance writer since 2016. She graduated from Sonoma State University with a degree in Communications and has been creating content for Insurify for nearly two years.

Can U Get Car Insurance With No License

Source: https://insurify.com/blog/car-insurance/car-insurance-no-license/

0 Response to "Can U Get Car Insurance With No License"

Post a Comment